Despite your knowledge and experience in stock market and mutual funds, a national mutual fund distributor like AssetPlus, of which I am a Partner, can guide and assist you very much to avoid possible pitfalls in the investment journey. Moreover, the client application of AssetPlus that can be installed on your mobile phone is widely known to be much user friendly in comparison to the apps provided by similar companies. Not only that this app would serve as a tool to monitor the performance of the funds you have invested in but also would function as a communication between you and your Distributor/AssetPlus.

In order to complete the process registration smoothly it’s better to keep the following ready.

1. PAN Card

2. Aadhar Card

3. Bank Account Details (including IFSC Code)

4. A passport size photograph

5. A photo of your signature in white paper

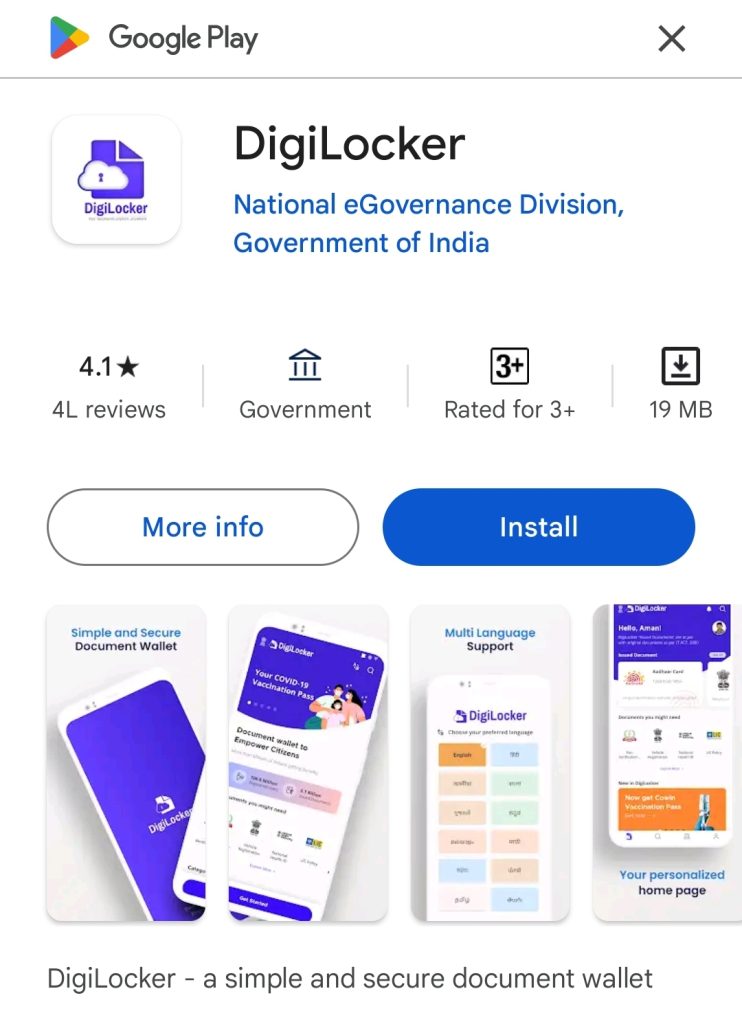

6. A DigiLocker account on mobile

If you don’t have Digi Locker on your mobile, it would be better to install it beforehand as the eKYC would be faster with DigiLocker. DigiLocker is a government of India initiative to empower citizens to store important documents digitally. You can download DigiLocker from Google Play/App Store of your mobile phone. Once DigiLocker ap is downloaded open it and Register/Login with your Aadhar Card.

When you are done with the preparation as described above, click on the below link to start the registration process of AssetPlus. Click to register

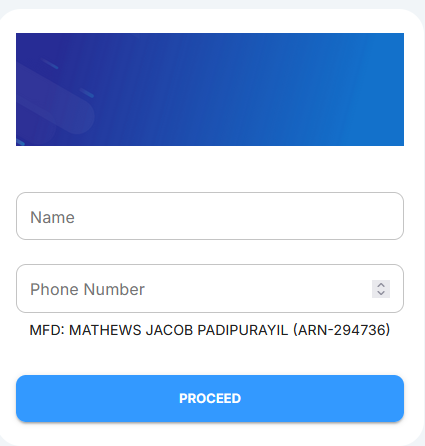

Below screen will appear. Enter your name and phone number and click on PROCEED button.

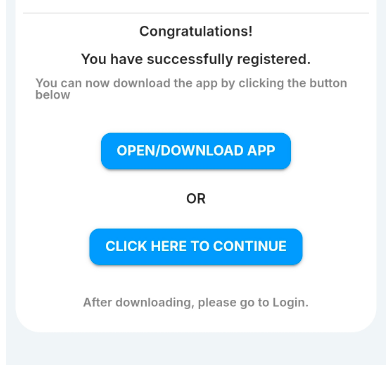

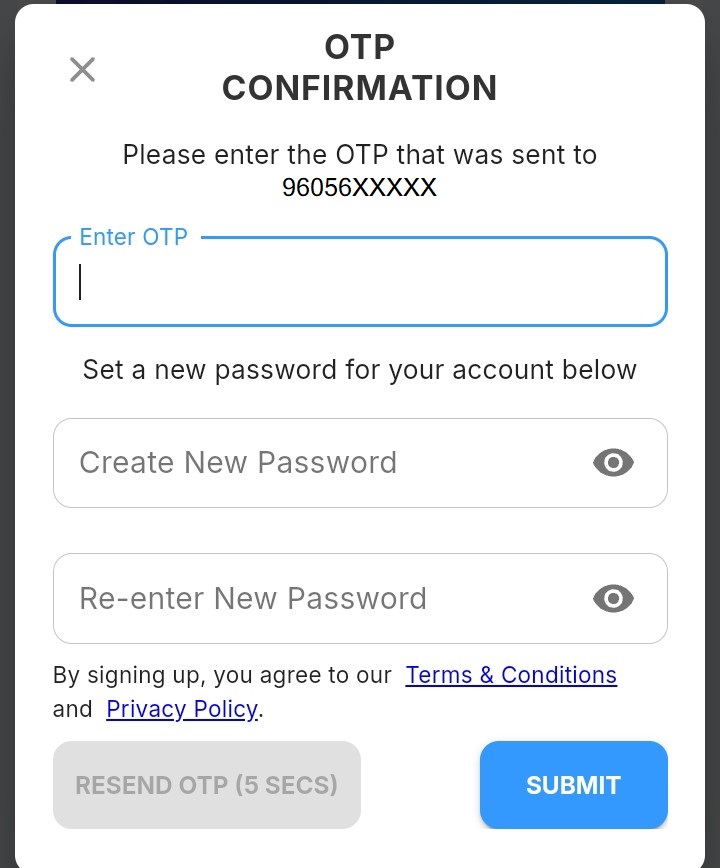

Enter the OTP received on your mobile in the box appeared on the screen. Another screen will appear wherein you need to set a Password and enter the password again to confirm it. The below message shall appear when the first phase of registration is complete.

Download AssetPlus client App. Open the App. When you enter your Phone number the below screen to set your Password will appear.

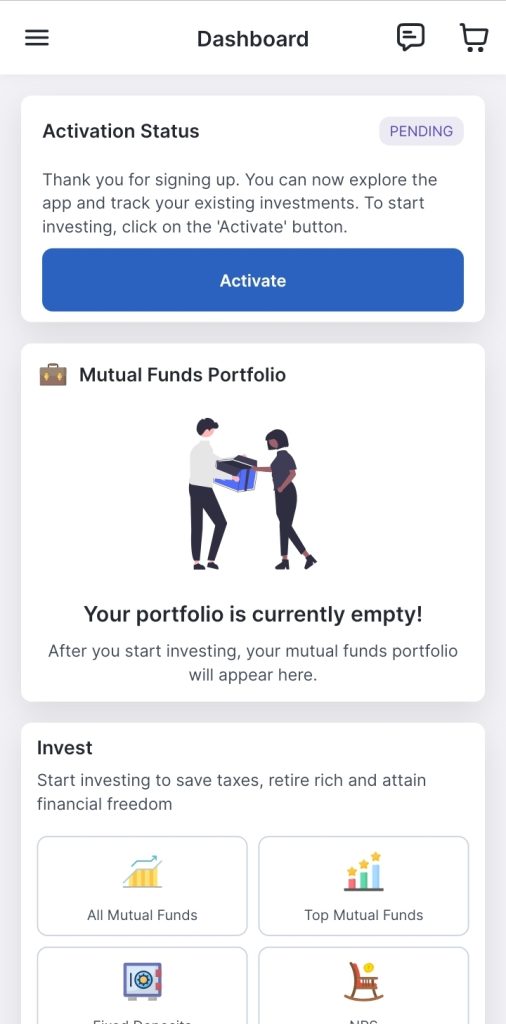

Enter the OTP received on your mobile and set the password. Click the Submit button. You will come to the dashboard of the application as given below.

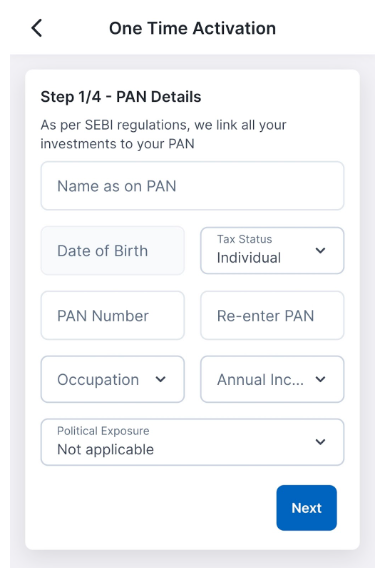

Click Activate button. The below screen will appear.

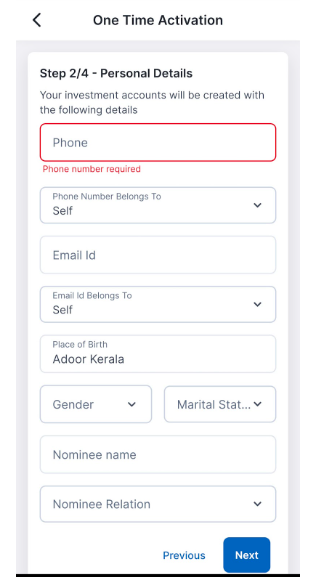

Enter your PAN details and click on the Next button. The below screen will appear.

After entering all personal details click the Next button. The screen shown below will appear.

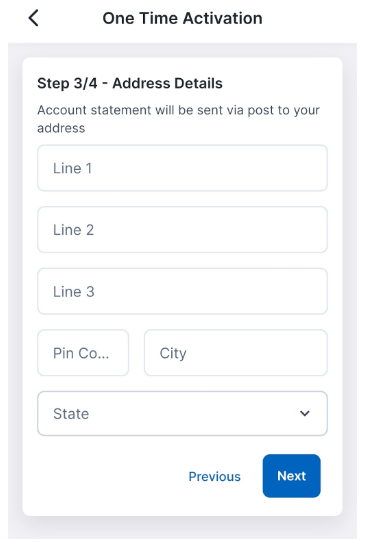

Enter all the address details and click Next button. The below screen will appear.

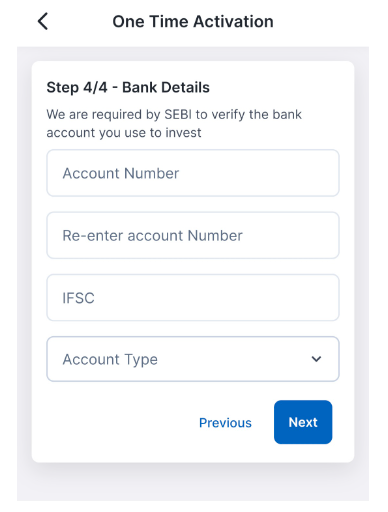

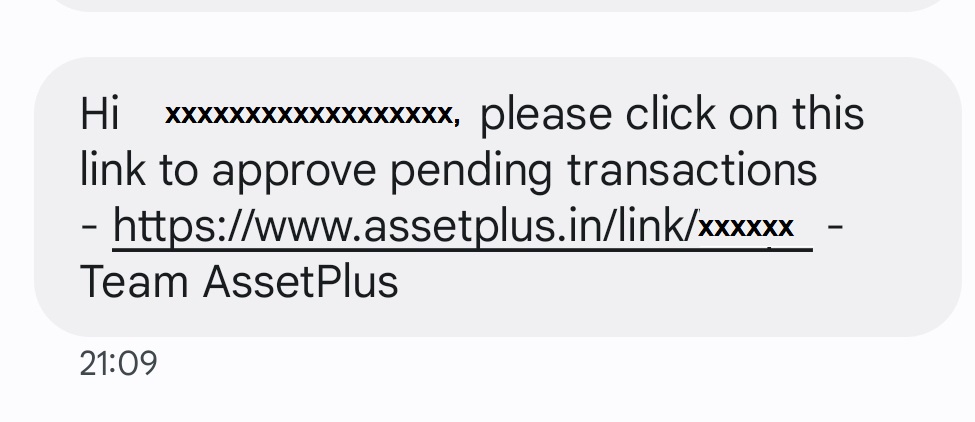

Enter all the bank account details and click Next button. The below screen for signature will appear.

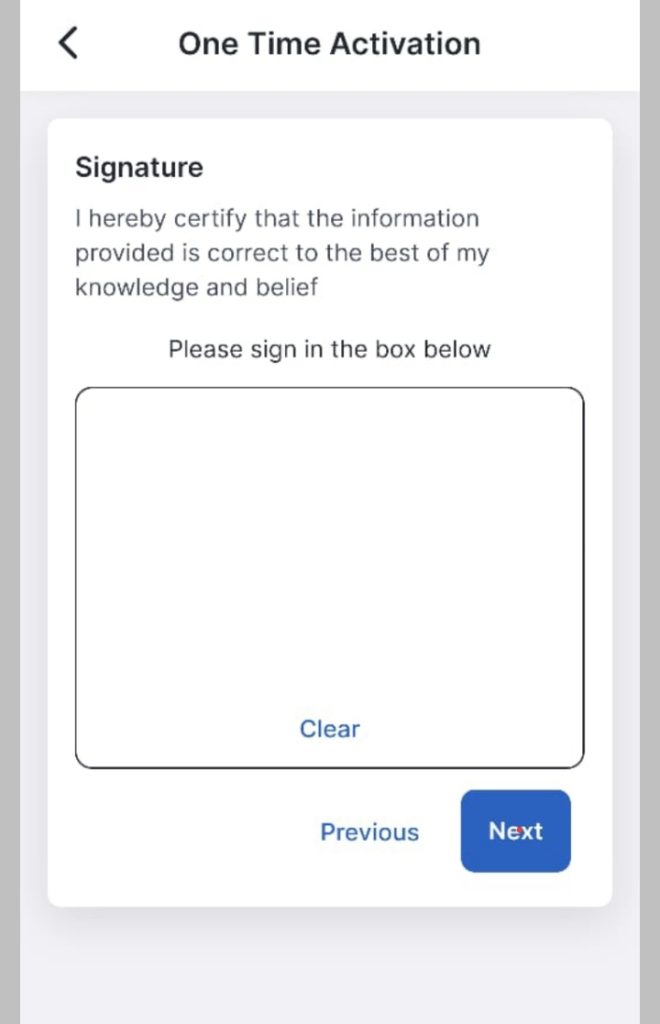

You need to put your signature with a finger or stylus pen in the box provided. Click Next Button.

Check your SMS. You will get a message similar to the one below.

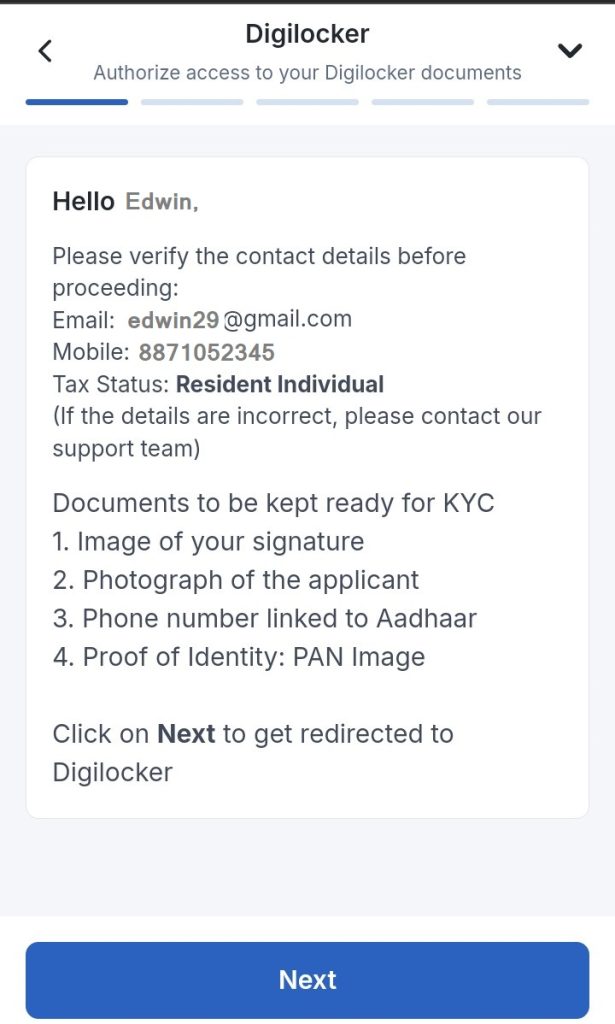

Click on the approval link provided in the SMS. The below screen will appear. Keep the listed documents ready and click Next button.

If you are ready with all listed documents, click the Next button. Below screen will appear.

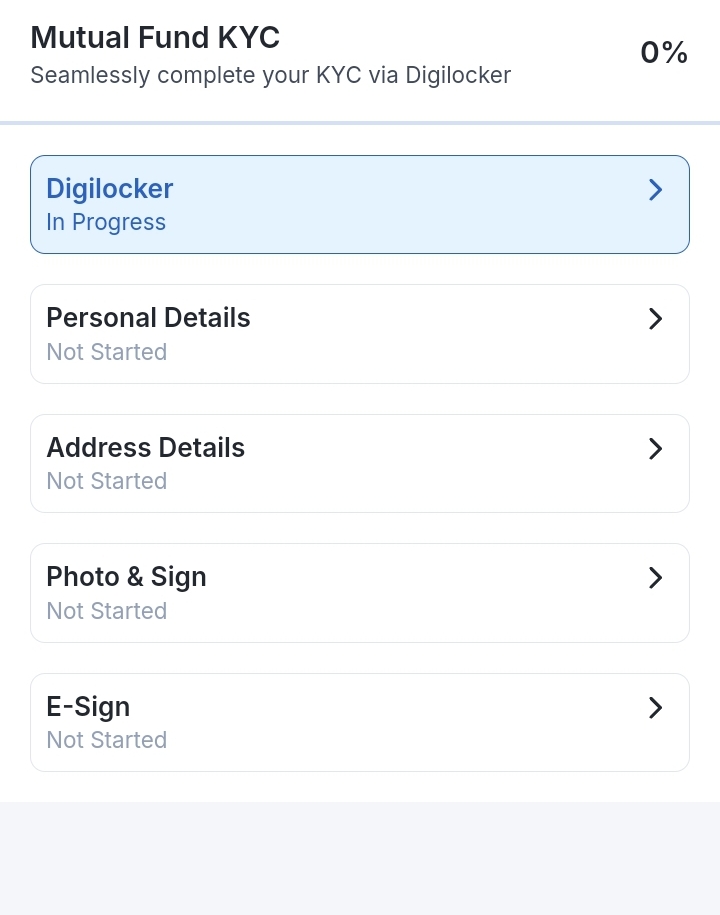

Click on the arrow next to DigiLocker. Below screen will appear.

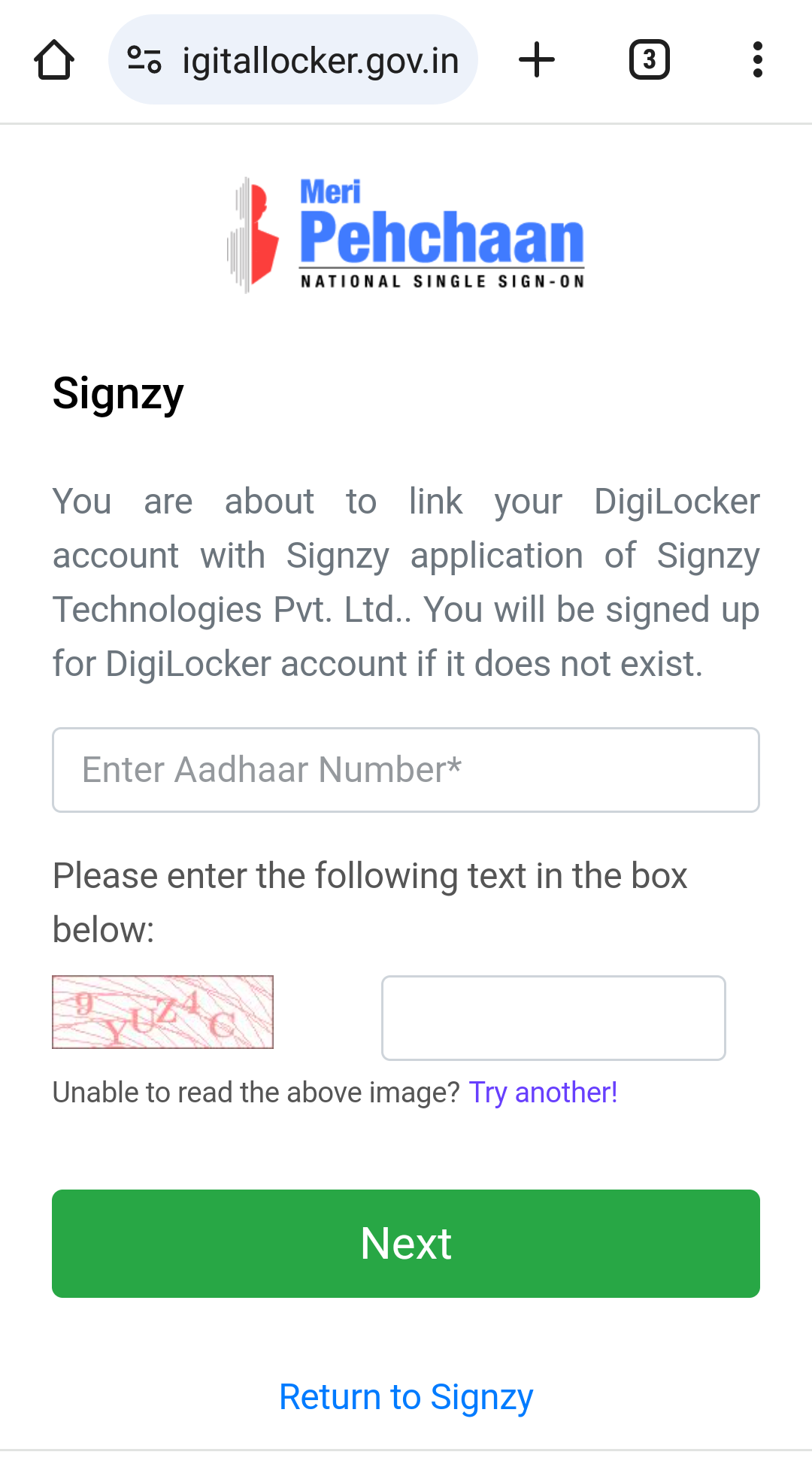

Enter the Aadhar Number and CAPTCHA code. Click the Next button. You will get an OTP in the Aadhar registered mobile. In the next screen you will be able to enter the OTP and proceed with eKYC. thru DigiLocker. Call me if any assistance needed at any time.

Related Blogs

Mutual Fund- A Safe Way to Invest Saving Habit and Mutual Funds SIPs Systematic Withdrawal Plan