A Systematic Withdrawal Plan (SWP) is a Mutual Fund plan wherein the investor withdraws a fixed amount from the lumpsum he invested in the mutual fund in a systematic and regular manner. This strategy is particularly beneficial for retirees or individuals seeking a steady income stream from their investments.

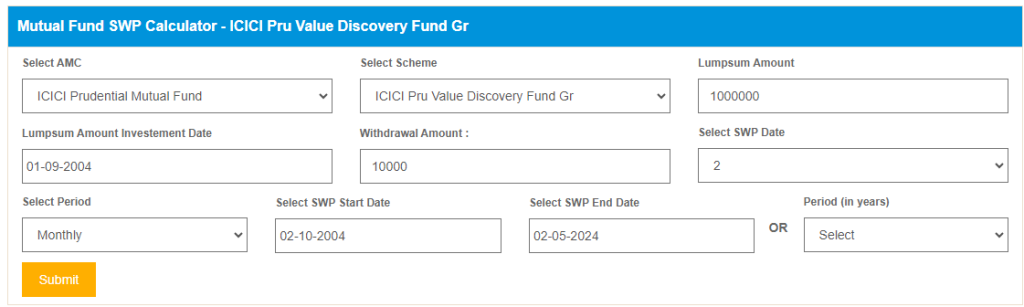

Let us evaluate a mutual fund scheme in order to assess the effectiveness of the scheme. There are many calculators available on the internet to find out how a selected mutual fund scheme had fared. I am using fund calculator of Advisor Khoj at https://www.advisorkhoj.com/mutual-funds-research/mutual-fund-swp-investment-calculator. You are free to select any calculator for this exercise. Once the calculator is open enter the following details.

AMC: ICICI Prudential Mutual Fund

Scheme: ICICI Value Discovery Fund Gr

Lumpsum Amount: 1000000 (10L)

Lumpsum Deposit Date: 01-09-2004

Withdrawal Amount: 100000

SWP Date: 2nd

Select Period: Monthly

SWP Start Date: 01-09-2004

SWP End Date:02-05-2024

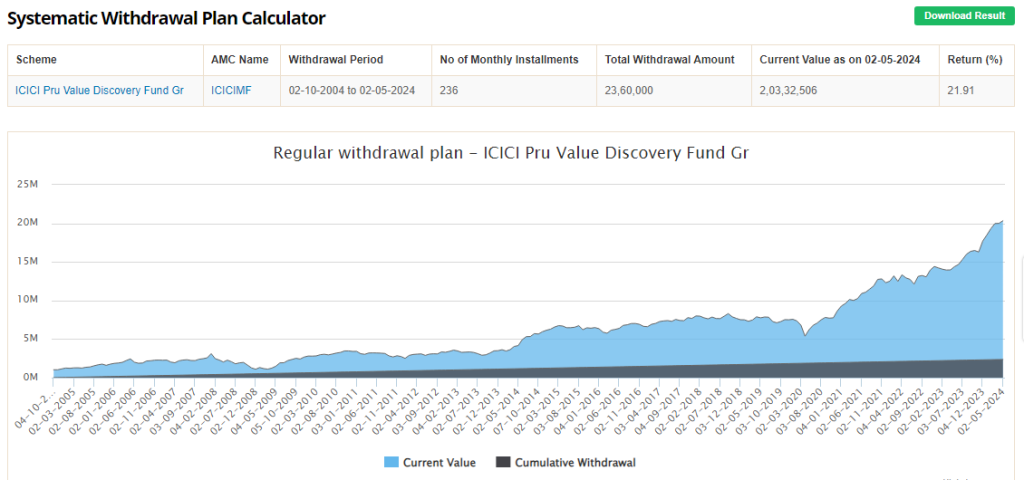

After entering the above data click on the submit button. Now a chart will appear on the screen.

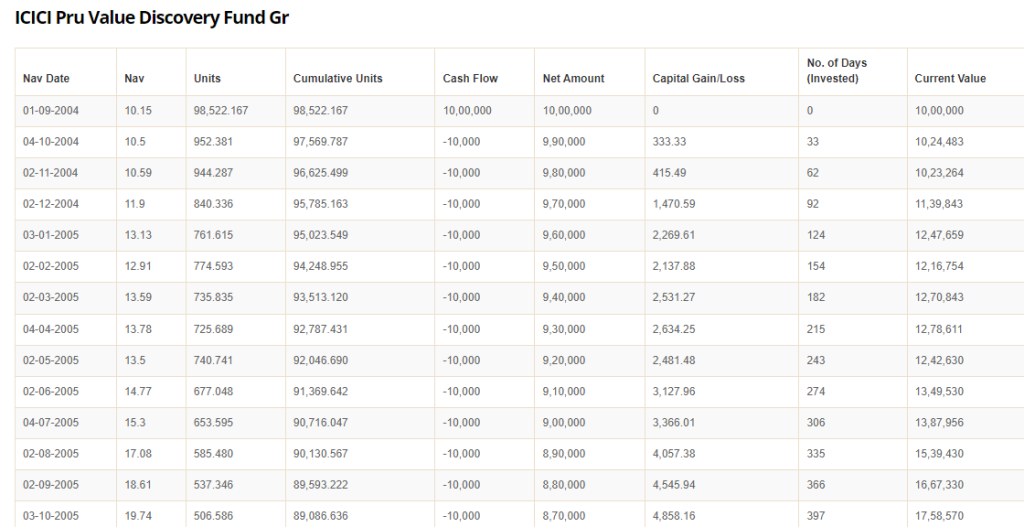

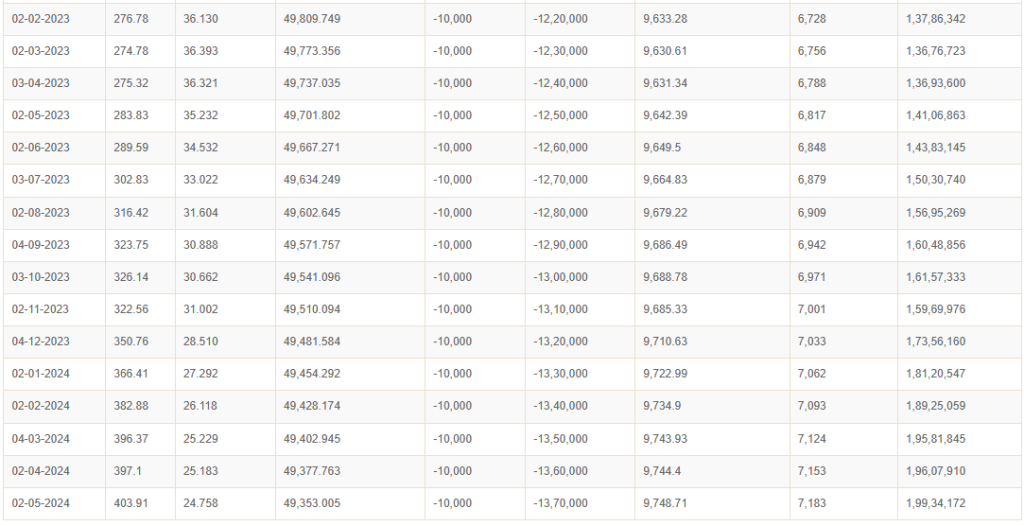

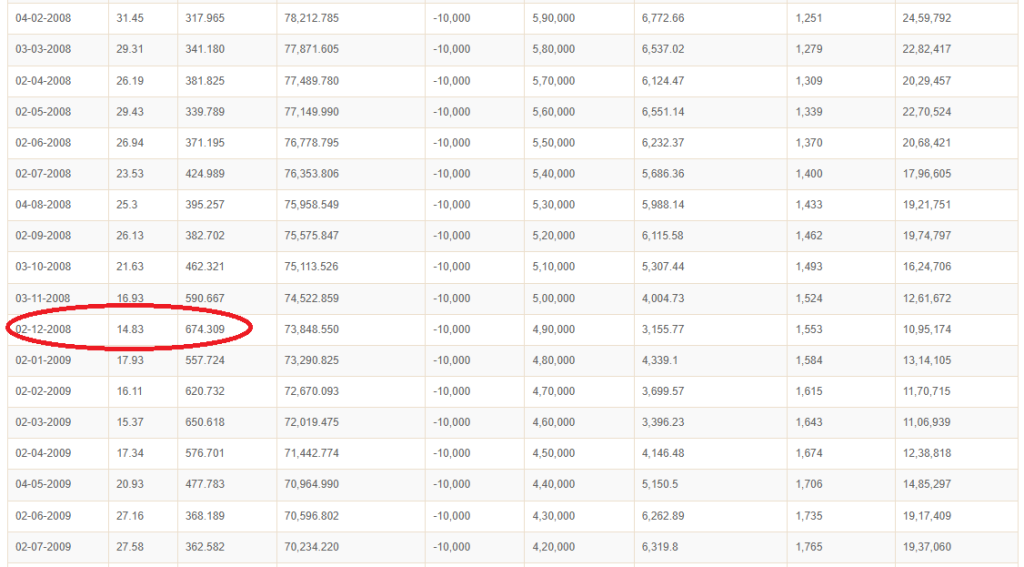

If you click on the green Download Report button, a full report for the period can be downloaded to your device. In order to simplify the illustration, I’m projecting only the first and last screens of the report here.

Certain things are to be highlighted here. The initial value of the fund on 1-Sep-2004 has been Ten Lakh (10,00,000). The present value of the fund is One Crore Ninety Nine Lakh Thirty-Four Thousand One Hundred Seventy Two (1,99,34,172). The period of growth is 19 years and 9 months or 237 months. That means, an amount of Twenty-three Lakh Seventy Thousand (23,70,000) is already withdrawn by way of 10,000 per month. Hence total value is equivalent to Two Crore Twenty-Three Lakh Four Thousand One Hundred Seventy Two (2,23,04,172).

Let us examine another side of the same plan we have evaluated earlier. Soppose, instead of Ten Thousand per month Twenty Thousand has been withdrawn in 237 months. The fund value would have been only Seventy Four Thousand Two Hundred Fifty Six (74,256) on the last day. Adding the Forty Seven Lakh Forty Thousand (47,40,000) withdrawn in 237 months the return becomes only 48 Lakh. This is very low in comparison to the Two Crore Twenty Three Lakhs return of the earlier case. This means, if above a certain percentage of the principal amount is withdrawn, the growth rate of fund falls significantly.

Here, the numbers speak for themselves. Can anyone propose a better way to grow the investment in this manner? I am not implying that anyone who start investing in Mutual Fund SWP will be able to reap a return proportionate to this. This is only a simple and straight forward attempt to illustrate how those who invested in Stock Market or Mutual Funds in India in the last two decades made a fortune. Like all securities, Mutual Funds are subject to market risk.

Two things matter. One, the investment should be for a long period. Second, despite fluctuations in market, hold on to the investment plan. In our example itself it’s interesting to note that during the recession in 2008, the NAV fell to 14.83. Those who panicked at that time and sold the holdings will be seen as quiet unfortunate persons.

Wish you all a prosperous investment journey!

SWP Mutual Fund Plan can be considered as an unavoidable part of Retirement Planning. There are many who are afraid of investing in the Stock Market directly. And the fear is not totally unfounded. There are many who lost their money in the Stock Market due to their entry in a casual manner without studying about various aspects of the Stock Market. Mutual Fund investment is a blessing for those persons. But there are a few who do not believe in the Indian Stock Market and even indirect investment in it through Mutual Funds. Absence of a printed guarantee paper explicitly stating that a certain amount will be credited to your account periodically is the trigger for this fear. Well, ICICI – Prudential Life Insurance Company has lot many guaranteed products like ICICI-PRU GPP (Guaranteed Pension Plan), ICICI-PRU GPP Flexi, ICICI-PRU Gold etc. These products ensure guaranteed pension in the bank account till the age 99. One can sleep well without any fear of turbulence in the share markets and chances of losing money. To know more about these products, please call +917907228608.

Related Blogs

Mutual Fund- A Safe Way to Invest

Saving Habit and Mutual Funds SIPs

Register as a Client at AssetPlus with Me and Start Your Investment Journey

Start Investing Today

Discover the potential of mutual funds with our expert guidance and secure financial future.